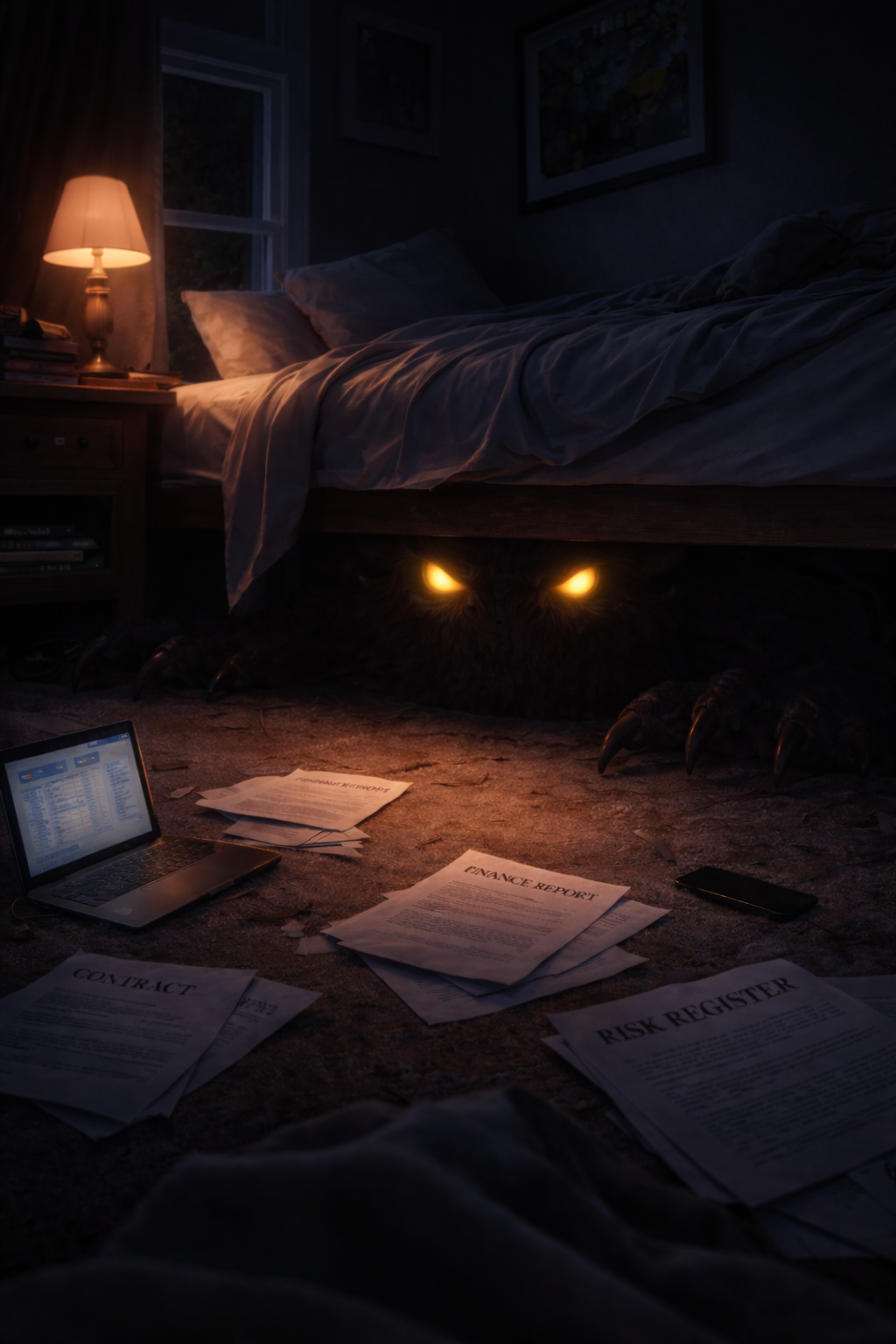

The monster under the bed was always in the contract

Many cloud strategies were built on assumptions that were never written down. Prices would not rise. Services would not disappear. Performance would hold. None of that was guaranteed. When assumptions live outside the contract, they stop being comfort and start being risk.

A remarkable number of cloud strategies are built on assumptions that never made it into a contract.

For years, many cloud teams repeated the same lines to management with confidence: AWS never raises prices. AWS does not shut services down. Things only ever get better with time. These beliefs were rarely challenged, largely because history seemed to support them.

Crucially, they were not contractual guarantees.

They were habits of thought, reinforced by past behaviour and repeated long enough to feel solid. They shaped financial models, commitment strategies, and executive reporting. Risk registers stayed quiet.

That is why the recent changes matter. They are not dramatic. They are clarifying.

If something sits in your assumptions but not in your contract, it is not protection. It is risk. And risk belongs explicitly in your systems, not implicitly in your plans.

When prices fall, AWS makes noise

In June 2025, Amazon Web Services announced GPU price reductions of up to 45 per cent. The message was everywhere: blog posts, press releases, headlines. AWS was once again ‘passing scale on to customers’.

This was intentional. Falling prices were part of the AWS story.

When prices rise, AWS stays silent

In January 2026, AWS raised GPU prices by roughly 15 per cent. There was no announcement.

On Saturday 4 January, the p5e.48xlarge instance–eight NVIDIA H200 GPUs – increased from $34.61 to $39.80 per hour. For teams running continuous workloads, that is around $3,700 more per month per instance. The change was discovered by journalists, not customers. No email. No blog post. No explanation.

The asymmetry matters.

AWS wanted credit for the reduction. It did not want attention for the increase. Both applied to the same instance families. Only one was treated as news.

This is not about intent. It is about structure.

The end of a convenient belief

For a long time, AWS benefited from a widely shared assumption: prices do not go up.

That assumption was never guaranteed. Prices did rise indirectly through generational changes and rebalanced offerings. But the overall direction was stable enough that many organisations treated it as safe.

This time, there was no generational shift to hide behind. Prices went up because AWS could raise them.

The assumption broke because it was no longer useful to maintain it.

Price reductions used to be the point

The shock is sharper because early AWS behaved very differently.

In its first decade, AWS cut prices regularly, visibly, and proudly. Falling prices were a feature, not a side effect. Amazon S3 is a good illustration, with repeated reductions as infrastructure matured and scale increased.

AWS even formalised the habit. Price reductions had their own RSS feed and a dedicated category on the AWS News blog. It was deliberately noisy.

That rhythm slowed around 2016 and never returned.

The feed still exists, but the pattern tells its own story. In 2020, AWS announced five price reductions. In 2021, six. In 2022 and 2023, one each. In 2024, five. In 2025, three. In 2026, so far, none. The last update dates from August 2025.

This is not random. It is structural.

What the contract actually guarantees

The gap between assumptions and reality appears clearly in AWS contracts.

AWS publishes a comprehensive set of service-level agreements. Almost without exception, they cover uptime. Not performance. Not throughput. Not latency. Availability.

Take Kinesis. Its sole purpose is to move data. Yet its SLA says nothing about how fast data moves, how delayed it may become, or what happens when pipelines back up. If the service is technically ‘up’, the SLA is met.

This is the rule, not the exception.

AWS contracts protect against outages, not degradation. You can receive a clean uptime report while systems slow down, queues build up, and costs rise elsewhere to compensate. Contractually, nothing has gone wrong.

Once again, the assumption lives outside the agreement.